Happy New Year! Is 2024 your year to make a move?

We can expect more of the same in 2024. This means 2024 is a year to move.

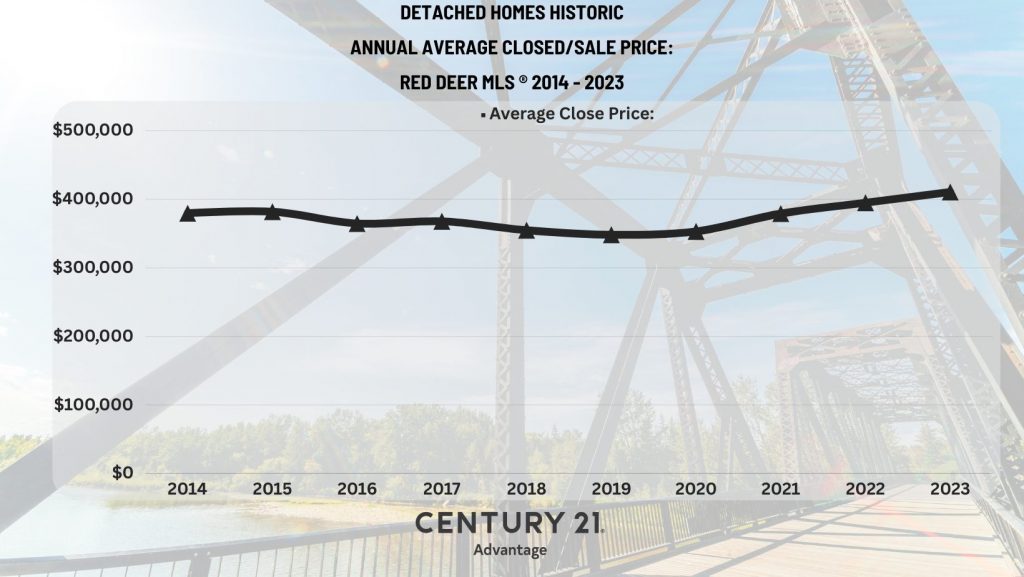

We finished the year with a similar trend that was happening in 2022. 2023 saw Red Deer and the area have low inventory levels, strong sale price to listing price, and in some cases price growth. The market was also decidedly different in homes above $500,000. Most likely influenced by the higher cost of borrowing.

Fortunately, 2024 is starting with rate holds, and the immediate forecast is the Bank of Canada will hold the rate further with declines.

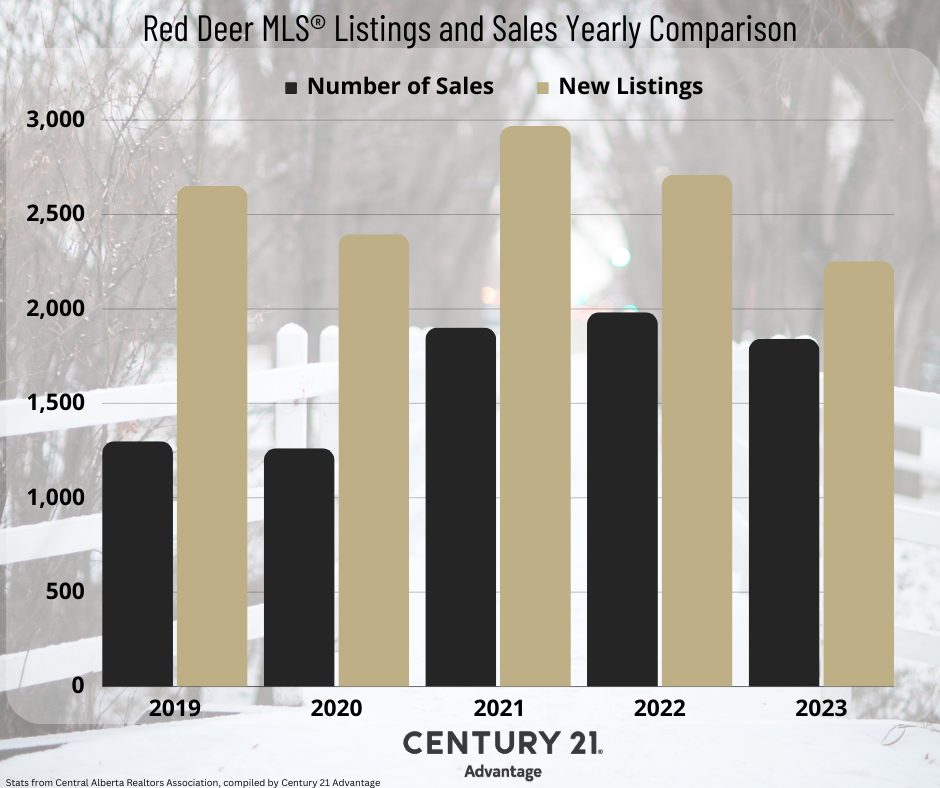

Did you know that in 2023 Red Deer real estate sales recorded the 4th highest sales volume of the last 10 years?

The Supply And Demand of Real Estate:

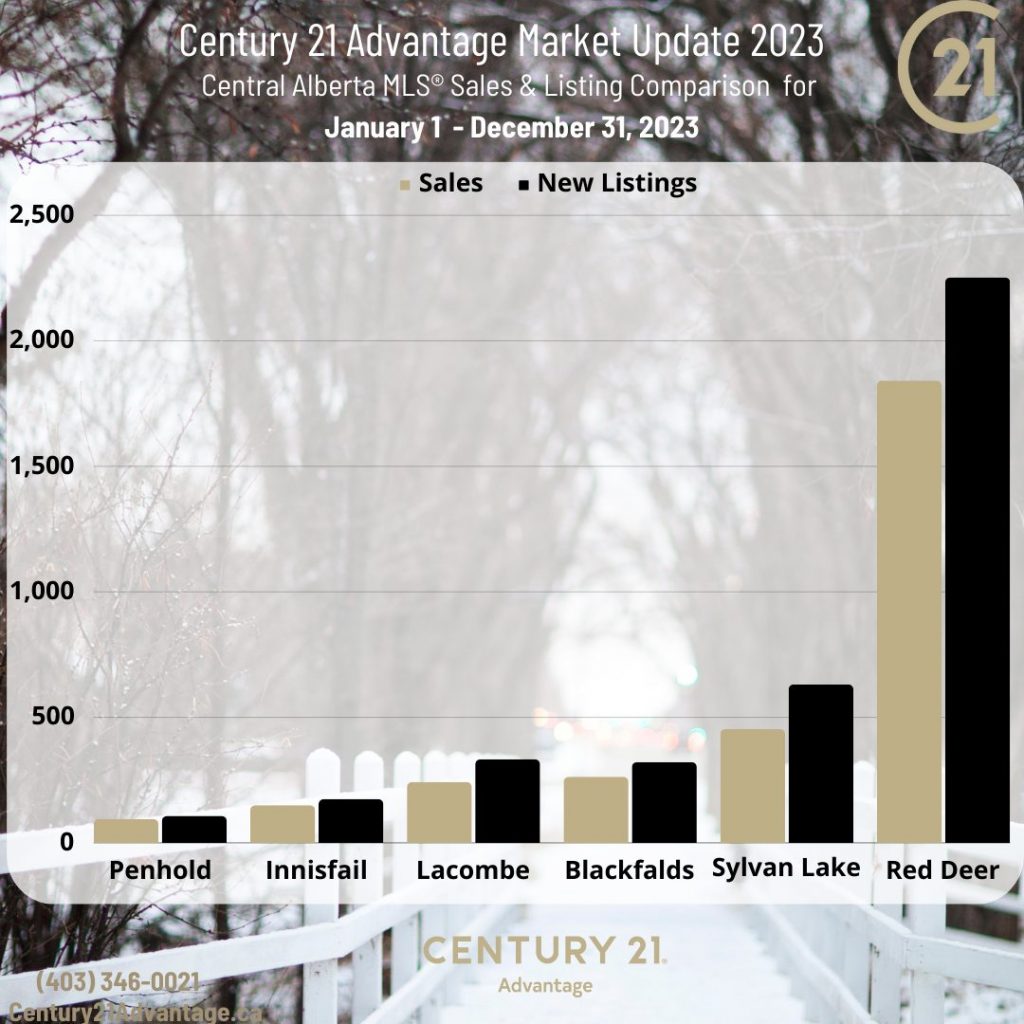

Sales volume in Red Deer and the area followed similar trends. Most communities have sales that closely follow the new listing volume. The tight supply and demand for real estate was a benefit to most sellers. Buyers were feeling the stress of finding something with time to process and evaluate being a premium commodity. 2023 saw an abundance of tenant-occupied homes for sale. The market was beneficial for quirky or tired homes, and those that generally might be a little thought to sell because of the wear & tear or needs of the home. As a result, we had many landlords that opted to change their portfolios.

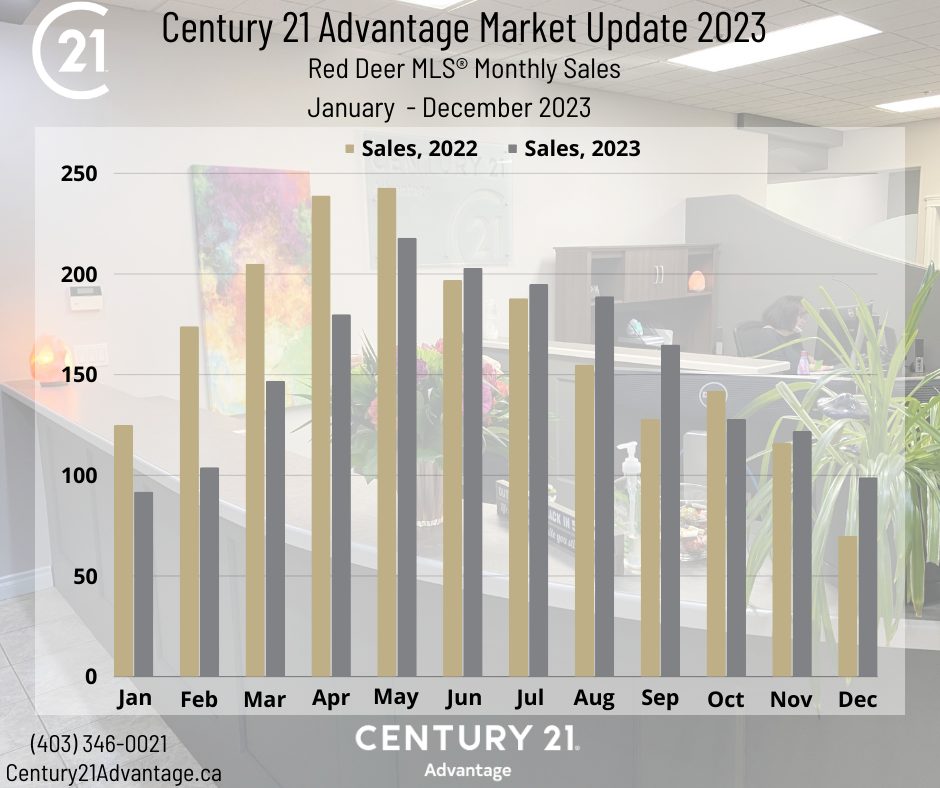

2023 had softer volumes compared to 2022. The rate increases that began in 2022 slowing down the real estate market.

The Bank of Canada interest rates are:

| Date* | Target (%) | Change (%) |

| December 6, 2023 | 5 | --- |

| October 25, 2023 | 5 | --- |

| September 6, 2023 | 5 | --- |

| July 12, 2023 | 5 | 0.25 |

| June 7, 2023 | 4.75 | 0.25 |

| April 12, 2023 | 4.5 | --- |

| March 8, 2023 | 4.5 | --- |

| January 25, 2023 | 4.5 | 0.25 |

| December 7, 2022 | 4.25 | 0.5 |

| October 26, 2022 | 3.75 | 0.5 |

| September 7, 2022 | 3.25 | 0.75 |

| July 13, 2022 | 2.5 | 1 |

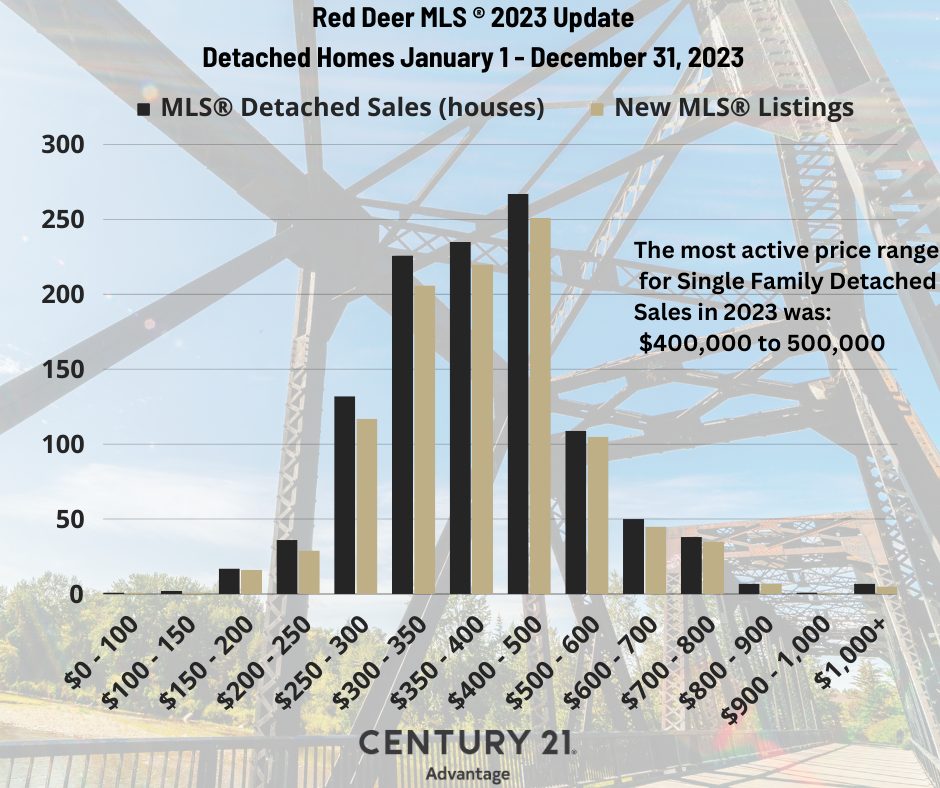

Sales By Price Range, The Impact of Interest Rates:

The impact on interest rate increases had a notable impact on house sales above $500,000.

Seasonal Flow:

The seasonal flow of sales echoed the trend of 2022 but seemed to ramp up late in the season when compared to 2022. The quietest months for real estate are usually December and January. Not that moving during -20º or-30ºC is all that desirable. Throw in the fact that we all bought presents and travelled to visit friends and family for a week or two for Christmas, it's pretty easy to see that these two months are sleepy by comparison.

Knowing that lending rates have plateaued, and may decline in the spring, are you planning on buying or selling this year?